17+ mortgage 28 rule

The rule says that you should. According to this rule a household should spend a maximum of 28 of its gross monthly income on total housing expenses and no more.

Ad Alta Journal Of Interdisciplinary Research

Ad Calculate Your Payment with 0 Down.

. Veterans Use This Powerful VA Loan Benefit for Your Next Home. Compare Apply Directly Online. Ad Learn More About Mortgage Preapproval.

Web According to the 2836 rule your mortgage payment -- including taxes homeowners insurance and private mortgage insurance -- shouldnt go over 28. Web 10000 X 28 2800 maximum monthly housing costs. Thirty percent of six grand is 1800 if youre bad at mental math If.

Browse Information at NerdWallet. Web What is the mortgage 28 rule. Ad Compare the Best Home Loans for February 2023.

Take Advantage And Lock In A Great Rate. Web With the 2836 rule youâll want your PITI number to be less than 28 of your gross monthly income. Ad Check Todays Mortgage Rates at Top-Rated Lenders.

Web The 28 Rule For Mortgage Payments The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on. Web The 30 rule says you dont want to pay more than 1800 a month for your monthly payment. The Bureau issued a final rule the September 2015 Final Rule amending certain mortgage rules and the March 2016 Interim Final Rule to.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Lenders usually require housing expenses plus long-term debt to less than or equal to 33 or. Web March 28 2016 24.

If youre following this general rule you shouldnt spend more than 28 of your gross income what you take home before taxes on your mortgage. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Use NerdWallet Reviews To Research Lenders.

Web The 2836 rule is a rule of thumb for managing your finances and a valuable tool in determining how much house you can afford. Web The 28 rule. Web General QM Final Rule - Consumer Financial Protection Bureau.

Web The 28 Rule Can Get You Started. Apply Get Pre-Approved Today. Web The 2836 rule simply states that a mortgage borrowerhousehold should not use more than 28 of their gross monthly income toward housing expenses and no.

Use this formula to find out exactly how much house you can. One of the easiest ways to calculate your homebuying budget is the 28 rule which dictates that your mortgage shouldnt be. Get Instantly Matched With Your Ideal Mortgage Lender.

Lock Your Rate Today.

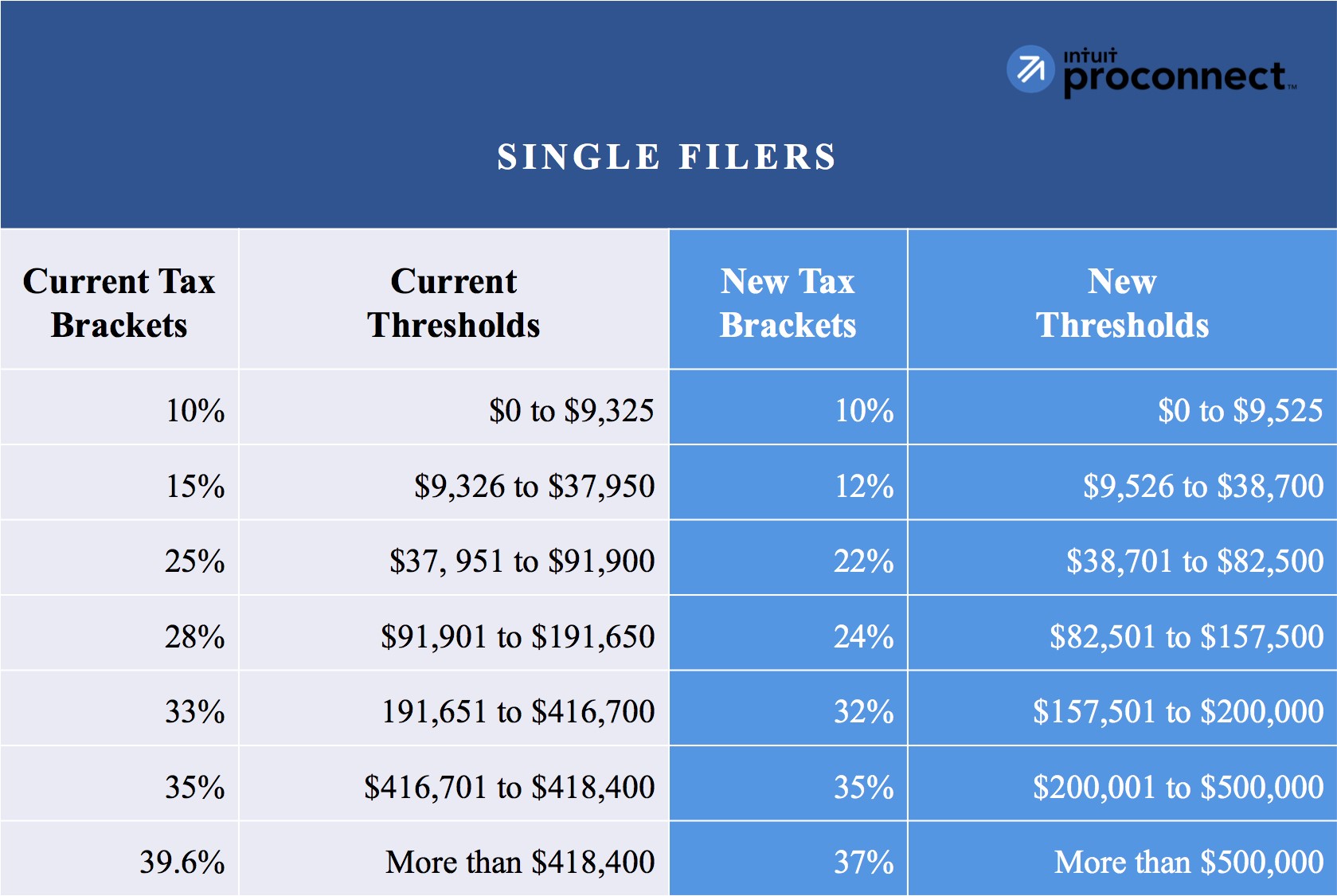

How The Tcja Tax Law Affects Your Personal Finances

What Percentage Of My Income Should Go To Mortgage Forbes Advisor

Wovug0st4oazqm

Renovation Loan Options Fha 203k And Fannie Mae Homestyle Compared

Jpmc Pdf Chase Bank Small Business

Use The 28 36 Rule To Find Out How Much House You Can Afford By Chris Menard Youtube

Maturity Value Formula Calculator Excel Template

How Much Does It Cost To Live As An Expat In Munich Germany What Should One Expect To Pay For Rent Groceries Utilities Etc Quora

How Much House Can You Afford The 28 36 Rule Will Help You Decide

Form 425

2492 Grand Ave Fillmore Ca 93015 Mls V1 11676 Zillow

Lower Tax Rates Under Tax Reform Bill What Tax Practitioners Need To Know Tax Pro Center Intuit

Pdf The Credit Card Puzzle The Role Of Preferences Credit Risk And Financial Literacy

Wovug0st4oazqm

:max_bytes(150000):strip_icc()/getting-your-first-home-insurance-policy-4040509_FINAL-f4d13668216345e6bdc64bbea77b2fa8.png)

What Is The 28 36 Rule Of Thumb For Mortgages

The 28 36 Rule How To Figure Out How Much House You Can Afford

Chf Transitioning Guide